Livelihood Savings Groups For Refugees

Savings groups act like a community bank. Refugees and host community members put their money in and can then ask for loans for business or the needs of their family. They repay back over time with interest. The groups also are encouraged to be involved in projects together to raise funds which are distributed yearly.

CRESS now supports 81 Savings groups in Imvepi Refugee Settlement, Rhino Camp, Mijale and the surrounding bush and Gabor. Each group has about 30 members, giving a total of 2,331 individuals.

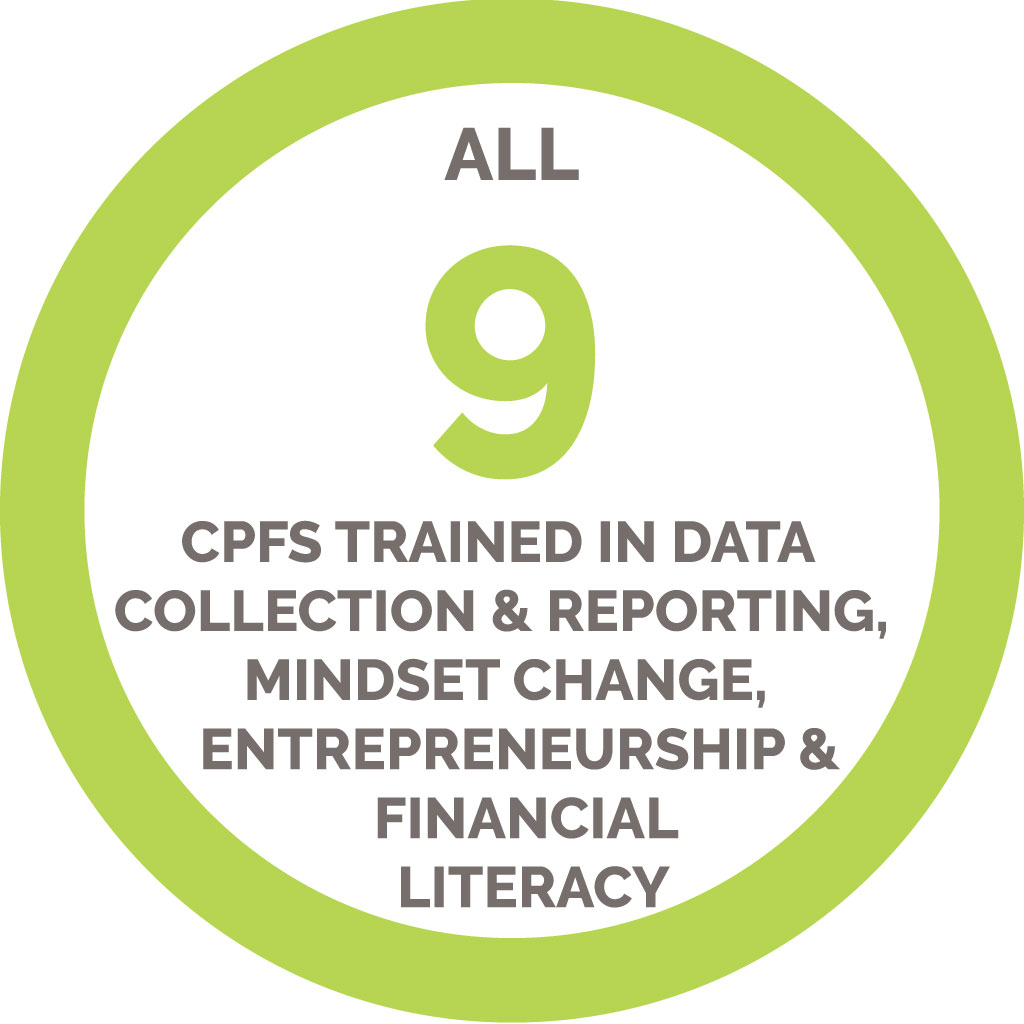

The groups are supported with a start-up kit containing a safebox and stationary. They also have training to teach them about savings and how to make the group work for them and continuing advice from a Community Process Facilitator (CPF). To enable the CPFs CRESS has been able to donate bicycles to them to travel between groups and continue to train them to ensure the best outcomes for the group members.

Key benefits

- Improved financial inclusion & access to credit

Refugees, often excluded from formal banking, use these groups as “village banks” to save regularly and take small loans affordably for emergencies or livelihood activities - Boosted household wealth and assets

Participation yields measurable improvements in home improvements like tin roofs and pit toilets, and increased livestock ownership - Enhanced resilience

Savings and credit from these groups help households handle unexpected costs—medical bills, school fees—and reduce income uncertainty

- Strengthened food security and nutrition

Access to financial resources supports better nutrition along with our agricultural training. - Empowerment through financial literacy and skills

Training in budgeting, record-keeping, and entrepreneurship is provided, facilitating small business ventures such as trading produce, computer and chair hire and more... - Leadership opportunities and gender equity

Many groups are women-heavy, enhancing women’s status, confidence, and decision-making within households and communities - Community cohesion and integration

These groups help bond refugees with each other and with host communities by empowering members to work together, invest in local economies, and share goals

Achievements

Savings Stories

Sam Ladu is a South Sudanese Refugee living in Northern Uganda, Yumbe district. Sam is 24 years old. He started business in 2016 in order to provide for his family paying for school fees, medication, clothing and feeding. His business was prospering, then conflicts emerged in South Sudan and all his stock was looted so he ran to Uganda with nothing. He lost his business, livestock, food, buildings and clothing.

In 2019 he joined a savings group called “Ngun lo tindu” (God’s gift). He borrowed a loan to pay his children’s school fees and to stock his business. He sells mixed goods in the local market of Kilaji-Mijale Zone.

Sam said, he owes CRESS and the team working with them here so much appreciation. “Through this unique and rewarding program, I am able to unbelievably revive my business. I have now established a business of my dream where, am able to make a minimum of 200,000/= shillings a week.”

Joyce is 29 years old and married with three children. She lives in Imvepi refugee settlement. She ran a restaurant business in South Sudan before the war broke out. She lost everything in the war. While in the refugee camp she heard about the CRESS-facilitated Savings Groups. She says:

- She learnt ways of generating money to save in the group.

- She was able to borrow money from the group and invested 80,000/= [£9] in a pancake, tomato and groundnut-paste business.

- She is now making about 150,000/= [£33] profit in her business per week.

- She is now able to buy food and clothes for her family.

“I plan to open a restaurant next year and construct a semi-permanent house made out of iron sheets and burnt bricks”